The aim of this article is to give a brief overview of the features supported by Bluefort TAPP for GoCardless and Microsoft Dynamics 365 Sales or Customer Service. No technical or programming knowledge is required in order to use this application making it very easy to deploy and configure. Bluefort TAPP is 100% free to use on sandbox and production environments. The standard GoCardless fees apply and we do not charge any custom app fees over and above the standard GoCardless fees.

GoCardless Onboarding

Bluefort TAPP allows you to seamlessly onboard your CRM environment to GoCardless. It automatically generates a URL which you can browse to in order to create a new GoCardless merchant for your organization or login and link to an existing GoCardless merchant to your CRM environment. The wizard is hosted within GoCardless and allows you to flow through easy and efficient legal onboarding.

Multiple GoCardless Merchants

It is possible to link your CRM organization to multiple GoCardless merchants. This is done by creating multiple onboarding records of type GoCardless Merchant. You can then choose which GoCardless merchant to use for specific customers or transactions potentially based on business unities or legal entities executing those transactions.

Define Default GoCardless Merchant

It is possible to define a default GoCardless merchant so that users do not have to choose a GoCardless merchant manually every time they need to capture a payment method or trigger a GoCardless Instant Bank Payment.

Direct Debit Mandates

It is possible to capture one or more GoCardless direct debit mandate for a customer and define the default. This means that if you do business multiple times with the same customer and/or on a recurring basis then you do need not to ask for payment information for each and every transaction but you can do this once and keep on using the same bank account linked to that mandate until the mandate expires or is cancelled. When a default mandate is configured for an account, all linked invoices are automatically settled using that mandate bank account. Mandates can be captured as follows:

- Using a customer onboarding URL – this is generated within Microsoft Dynamics 365 Sales or Customer Service and should then be sent over to the customer e.g. via email, using Microsoft Powe automate, or in a customer portal. When the customer browses the URL they are presented with a modern and intuitive wizard hosted by GoCardless to submit their bank details.

- Manually capturing bank details – Here bank details are captured manually via a portal, a tablet, on paper, etc. The bank details are than submitted to the GoCardless API to create a mandate.

Success+

Any GoCardless payment generated from TAPP can benefit from the artificial intelligence capabilities of GoCardless Success+. Success+ uses payment intelligence to manage and reduce payment failures. Recover, on average, 70% of failed payments. Failed payments are a concern for every business. Customers can unintentionally churn when their payments fail and 11-15% of uncollected funds turn into bad debt. Although not all customers are unwilling to pay, complex and manual collections processes give every customer the same payment recovery experience. Success+ intelligently manages your late payments. Automatically collecting 70% of failed payments on the day best suited to your customers. Creating a smoother experience for them and better cash flow for you.

Instant Bank Payments

For a specific invoice in Microsoft Dynamics 365 Sales or Customer Service, you can also generate a GoCardless Instant Bank Payment URL for your customer to settle a specific transaction. Cards have expensive transaction fees; bank transfers offer a poor customer experience; bank debit is not optimized for one-off payments. Instant Bank Pay is the GoCardless feature that makes it easy for your customers to pay by bank, using Faster Payments. These instant transfers mean better visibility for both you and your customers, save you time chasing one-off payments, and creating a smoother customer experience.

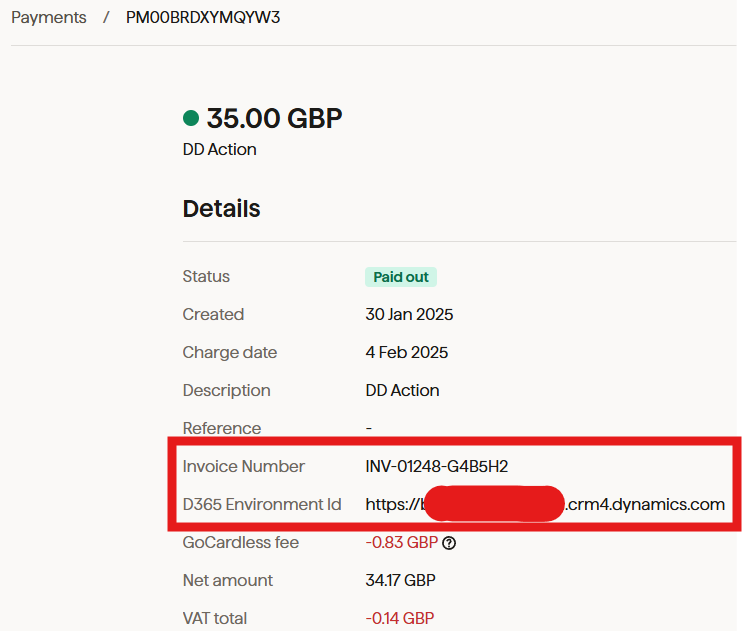

Custom Metadata

Out of the box, TAPP appends custom meta data to all GoCardless transactions. Thus, users access the GoCardless portal are easily able to identify the source environment and the specific transaction id (typically customer number for mandates and invoice number for payments) related to the record. This ensures maximum traceability and transparency without the explicit need to login to the Microsoft Dynamics 365 Sales or Customer Service CRM.

GoCardless Subscriptions and Membership Payments

Bluefort TAPP supports integrating with the GoCardless subscription and membership functionality and thus handle recurring payments efficiently and without headaches. Collect from 30+ countries without needing a local bank account. FX is handled for you, at the real market rate. Full control over your customers’ payment plans. Amend or pause plans, and collect one-off charges with ease.

TAPP augments the GoCardless subscription and membership functionality by allowing you to make a Microsoft Dynamics 365 invoice as a subscription template and thus trigger the recurring payment schedule at GoCardless. Subsequently, when GoCardless takes subscription payments from your customers’ bank accounts, TAPP will automatically generate and settle invoices in Microsoft Dynamics 365 Sales or Customer Service while sending back the invoice number as metadata back to GoCardless, thus reducing a lot of effort to manually create invoices, ensure maximum traceability and let the data be easily exportable for consumption in other business systems such as ERPs.

GoCardless Refunds

Using Bluefort TAPP it is possible to refund any customer payment.

Real-time alerts

Email notifications from the GoCardless platform keeps both merchants and customers aware of any failed payments or cancellations, mandate cancellations etc so you’re always notified and up-to-date..

Data reconciliation

It is possible to reconcile data from your GoCardless account down to your CRM environment. The reconciliation for the various data elements is available from the Onboarding record number of days from system date. If enabled for a specific reconciliation type, TAPP ships with out-of-the-box power automate flows which automatically synchronize the data every 24 hours. You can manually synchronize the data by changing the number of days you want to synchronize and saving the record.

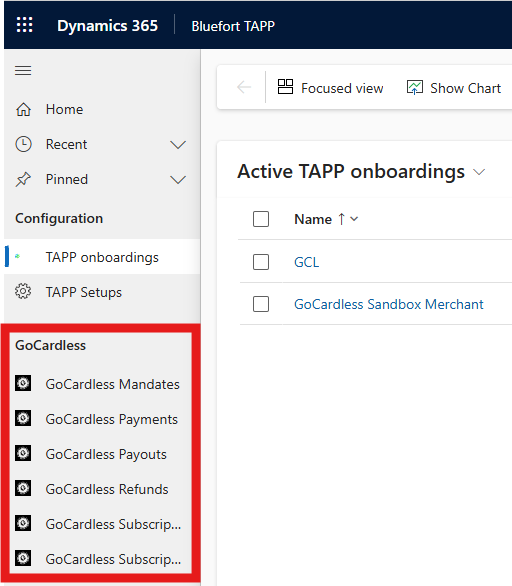

Once reconciled the data can be reviewed within the Bluefort TAPP model driven app from the main menu on the left-hand side of the application, as shown in the screenshot below.

The out of the box GoCardless data reconciliation types that can be synchronized are:

- GoCardless Mandates

- GoCardless Payments

- GoCardless Payouts

- GoCardless Refunds

- GoCardless Subscription Templates – these are invoices which triggered a recurring payment schedule.

- GoCardless Subscription Invoices – these are the invoices automatically created by TAPP after GoCardless makes a subsequent payment in the schedule

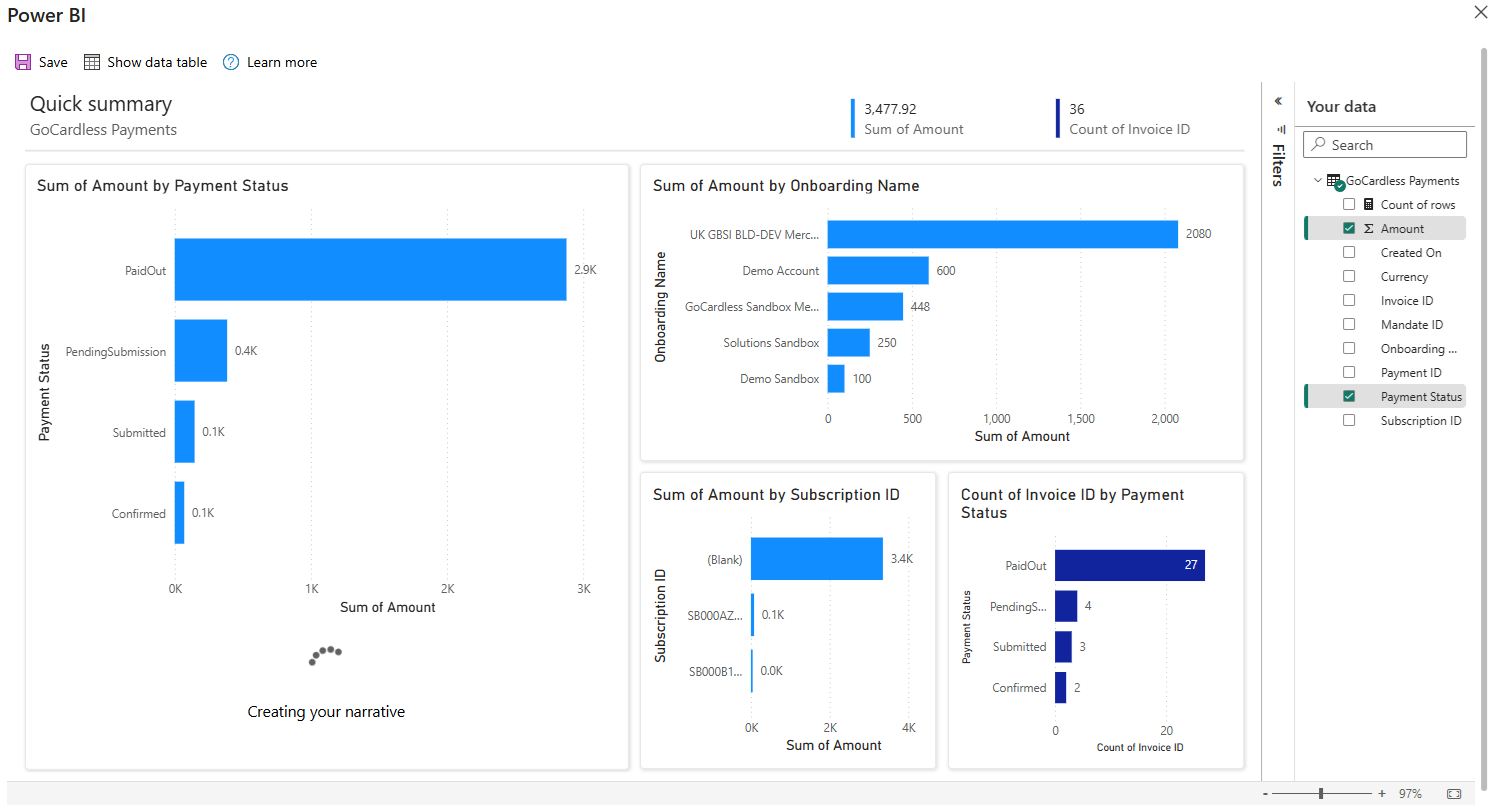

Analytics

For data present within the entities listed above it is possible to generate PowerBi charts for analytical purposes using the Microsoft Dynamics 365 for Sales OOB Visualize this view feature. Besides generating the chart views, the feature also allows you to filter, slice and dice the data. An example can be seen below.

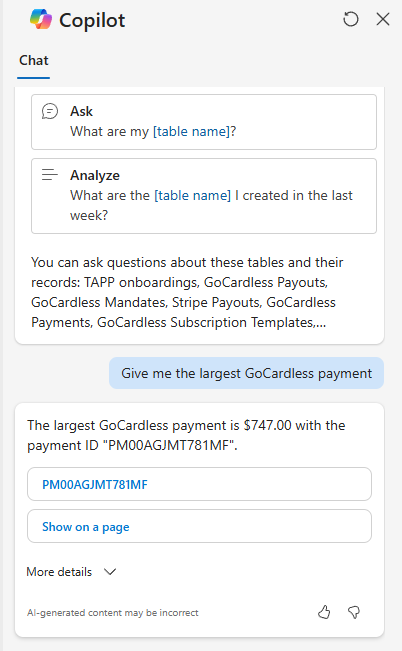

Co-Pilot Integration

Using Microsoft Co-Pilot features, you can interact with Bluefort TAPP data using natural language in the Co-Pilot slider on the right hand side of the Bluefort TAPP model-driven application. You can ask Co-Pilot various questions about your TAPP data without needing to have any technical knowledge and thus harness the power of Artificial Intelligence (A.I.) for your organization. An example can be seen below.