The aim of this article is to give a brief overview of the features supported by Bluefort TAPP for GoCardless and Microsoft Dynamics 365 Finance. No technical or programming knowledge is required in order to use this application making it very easy to deploy and configure. Bluefort TAPP is 100% free to use on sandbox and production environments. The standard GoCardless fees apply and we do not charge any custom app fees over and above the standard GoCardless fees.

GoCardless Onboarding

Bluefort TAPP allows you to seamlessly onboard your D365 Finance environment to GoCardless. It automatically generates a URL which you can browse to in order to create a new GoCardless merchant for your organization or login and link to an existing GoCardless merchant to your D365 Finance environment and legal entity (company). The wizard is hosted within GoCardless and allows you to flow through easy and efficient legal onboarding.

Multiple GoCardless Merchants

It is possible to link your D365 Finance environment to multiple GoCardless merchants. You can onboard one GoCardless merchant per legal entity or share one GoCardless merchant account across multiple legal entities.

Direct Debit Mandates

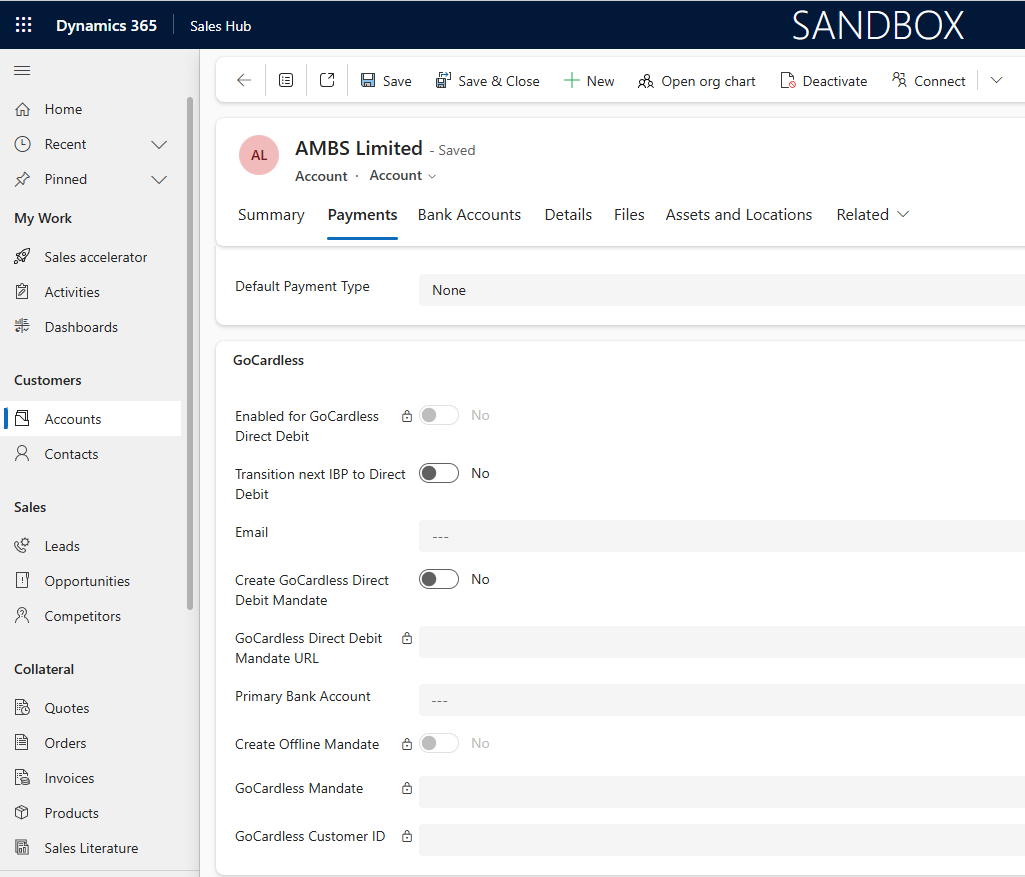

It is possible to capture one or more GoCardless direct debit mandate for a customer and define the default. This means that if you do business multiple times with the same customer and/or on a recurring basis then you do need not to ask for payment information for each and every transaction but you can do this once and keep on using the same bank account linked to that mandate until the mandate expires or is cancelled. When a default mandate is configured for an account, all linked invoices are automatically settled using that mandate bank account. Mandates can be captured as follows:

- Using a customer onboarding URL – this is generated within Microsoft Dynamics 365 Sales or Customer Service and should then be sent over to the customer e.g. via email, using Microsoft Powe automate, or in a customer portal. When the customer browses the URL they are presented with a modern and intuitive wizard hosted by GoCardless to submit their bank details.

- Manually capturing bank details – Here bank details are captured manually via a portal, a tablet, on paper, etc. The bank details are than submitted to the GoCardless API to create a mandate.

Direct Debit Payments

For sales orders, free text invoices or project invoices you can generate Direct Debit payments based on the default Direct Debit mandate configured for the customer linked to the transaction. Sales Orders could be standard or generated from the Subscription Billing module or Bluefort LISA subscription plans.

There is the possibility to manually switch off direct debit payments on specific sales orders, free text invoices or project invoices if you do not want to get paid using direct debit for this specific transaction.

Success+

Any GoCardless payment generated from TAPP can benefit from the artificial intelligence capabilities of GoCardless Success+. Success+ uses payment intelligence to manage and reduce payment failures. Recover, on average, 70% of failed payments. Failed payments are a concern for every business. Customers can unintentionally churn when their payments fail and 11-15% of uncollected funds turn into bad debt. Although not all customers are unwilling to pay, complex and manual collections processes give every customer the same payment recovery experience. Success+ intelligently manages your late payments. Automatically collecting 70% of failed payments on the day best suited to your customers. Creating a smoother experience for them and better cash flow for you.

Manual Retry for Failed Payments

If more control is required on triggering retries for failed payments and thus the merchant is not confident to use AI-enabled success+, then failed payments can be manually retried from within Microsoft Dynamics 365 Finance. It is only allowed to retry a failed payment for up to three times (this is a limitation from the payment providers).

Instant Bank Payments

For sales orders, free text invoices or project invoices, you can generate a GoCardless Instant Bank Payment URL for your customer to settle a specific transaction. Cards have expensive transaction fees; bank transfers offer a poor customer experience; bank debit is not optimized for one-off payments. Instant Bank Pay is the GoCardless feature that makes it easy for your customers to pay by bank, using Faster Payments. These instant transfers mean better visibility for both you and your customers, save you time chasing one-off payments, and creating a smoother customer experience.

Transition Instant Bank Pay to Direct Debit

It is possible to set a flag on the customer where you start off with an Instant Bank Payment which, if successful, will automatically transition to a Direct Debit mandate.

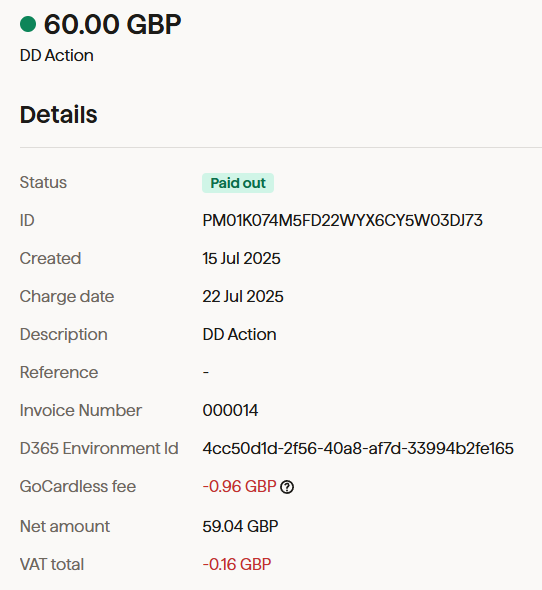

Custom Metadata

Out of the box, TAPP appends custom meta data to all GoCardless transactions. Thus, users access the GoCardless portal are easily able to identify the source environment and the specific transaction id (typically customer number for mandates and invoice number for payments) related to the record. This ensures maximum traceability and transparency without the explicit need to login to the Microsoft Dynamics 365 Finance.

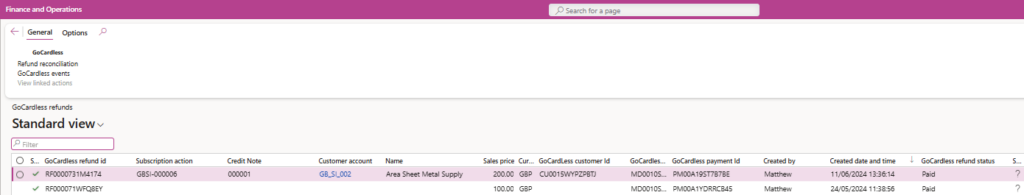

GoCardless Refunds

Using Bluefort TAPP it is possible to refund any customer payment by creating a credit note to a sales order, free text invoice or project invoice and leaving the GoCardless Direct Debit flag switched on if you would also like to refund the customer via GoCardless, instead of keeping the balance on account.

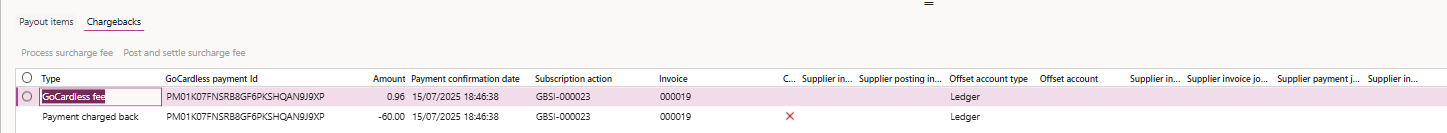

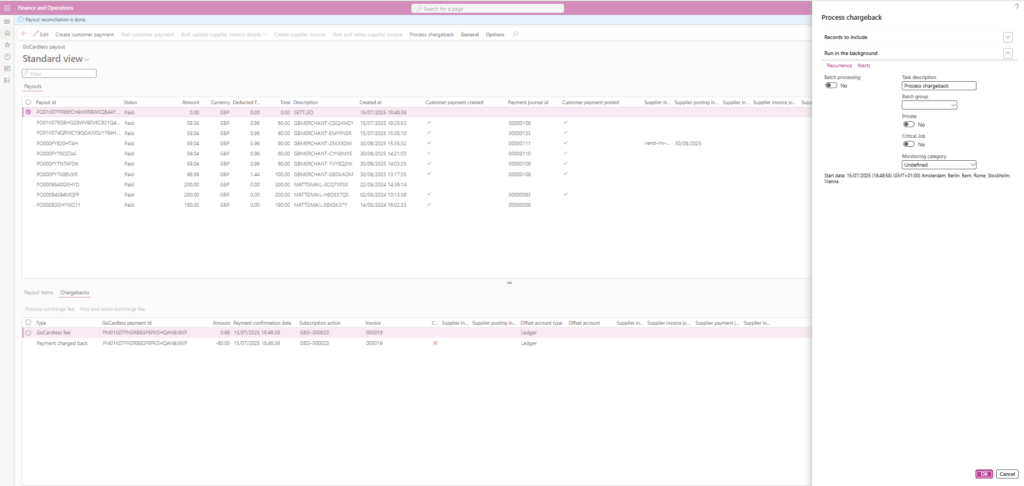

Chargebacks

Bluefort TAPP can also handle chargebacks. If the Process chargeback function is used, the automatic settlements previously posted against an invoice are all reversed.

Real-time alerts

Email notifications from the GoCardless platform keeps both merchants and customers aware of any failed payments or cancellations, mandate cancellations etc so you’re always notified and up-to-date.

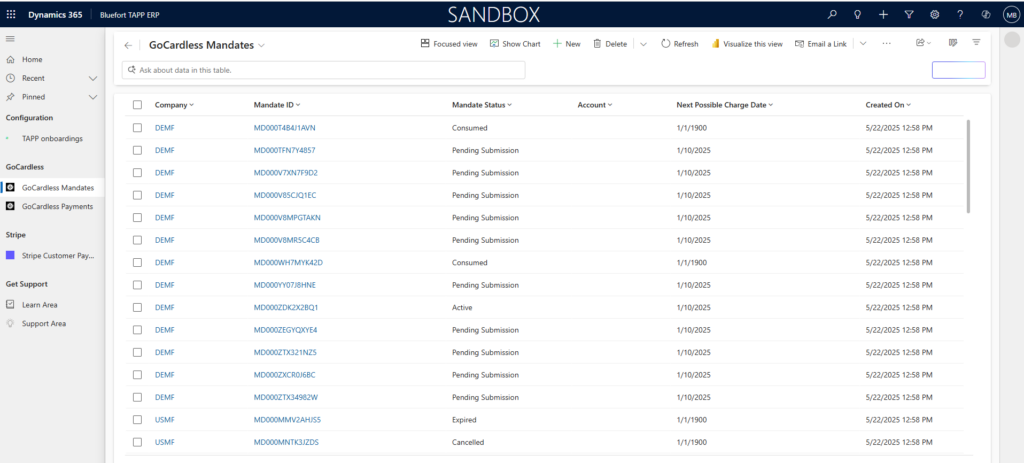

Data reconciliation

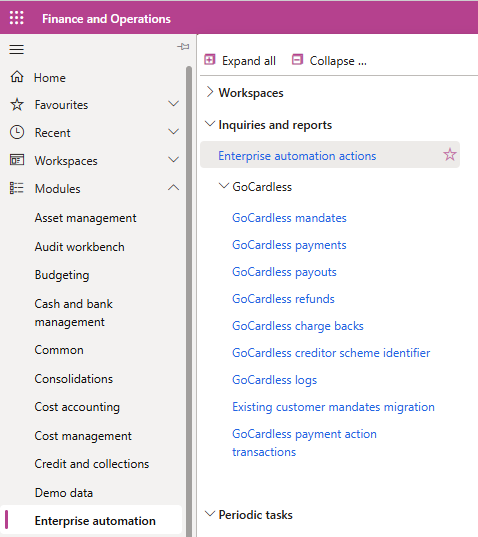

It is possible to reconcile data from your GoCardless account down to your D365 Finance environment. The reconciliation for the various data elements is available via the various periodic batch jobs which can be enabled both If enabled for a specific reconciliation type, TAPP ships with out-of-the-box batch jobs which automatically synchronize the data as per your business requirements. You can manually synchronize the data by using the buttons in the various inquiry forms.

Once reconciled, the data can be reviewed within the Enterprise Automation -> Inquiries and Reports -> GoCardless sub-menu, as shown in the screenshot below.

The out of the box GoCardless data reconciliation types that can be synchronized are:

- GoCardless Mandates

- GoCardless Payments

- GoCardless Payouts

- GoCardless Refunds

- GoCardless Chargebacks

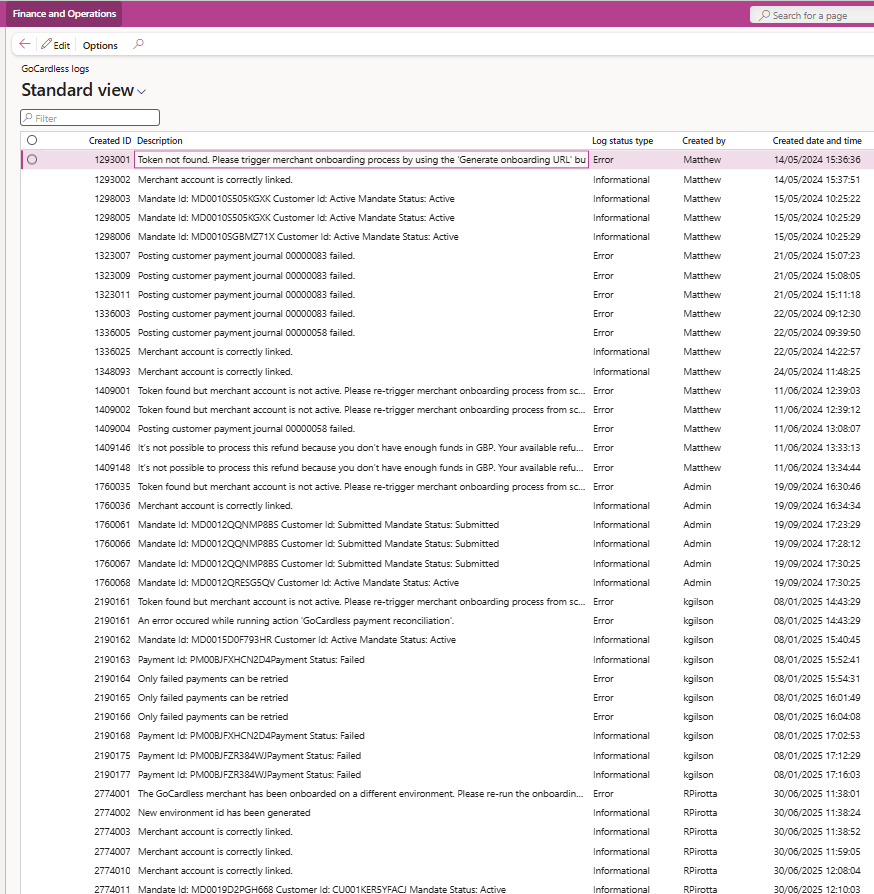

Logging

The GoCardless logs inquiry screen lets you view detailed logs of your environment’s interaction with GoCardless. This could be useful in troubleshooting scenarios.

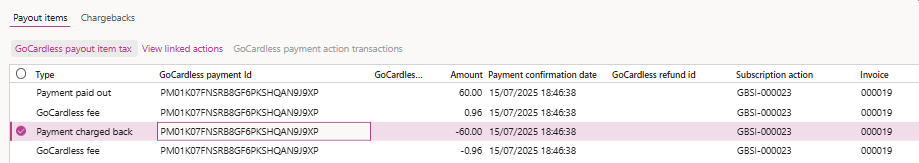

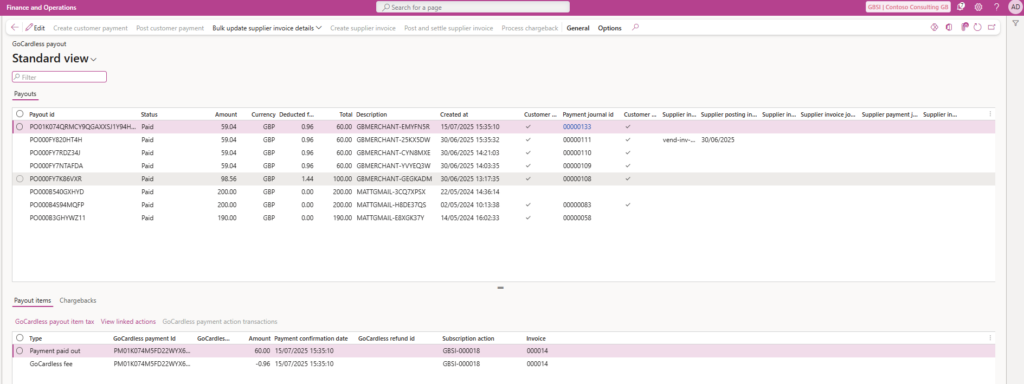

Automatic Customer and Supplier Settlements

TAPP provides a GoCardless payouts Cockpit. This shows the GoCardless payout data synchronized from the GoCardless service to FSCM. The functionality within the GoCardless cockpit allows you to automatically generate and post customer payment journals to automatically settle invoices which triggered the original GoCardless payments.

It also allows you to automatically create and post a vendor invoice journal and settle via an automatically created vendor payment journal to capture the charges from GoCardless.

All the above can be either triggered manually using the buttons available in the cockpit or configure batch jobs to automatically handle the processing.

On the customer side the above process creates and posts customer payment journals which affect the standard Microsoft Dynamics 365 Finance modules:

Sales Ledger (AR) – customer payment transactions and settlement of invoices

Cash and Bank Management – bank account transactions

General Ledger – ledger transactions for the above sub-ledger transactions (viewable via Audit trail)

Credit and Collections – Updates customer balances in credit and collections

On the supplier/vendor side the above process creates and posts vendor invoices and vendor payment journals which affect the standard Microsoft Dynamics 365 Finance modules:

Purchase Ledger (AP) – vendor invoice and payment transactions and settlement of both

Tax ledger – transactions that arise from posting the vendor invoice

General Ledger – ledger transactions for the above sub-ledger transactions (viewable via Audit trail)

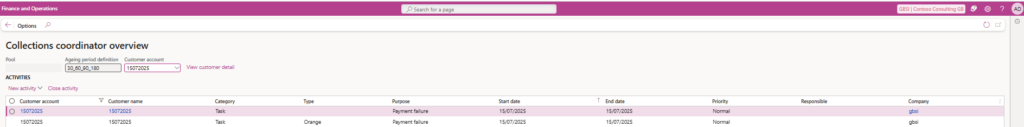

Integration with Credit and Collection Module of Microsoft Dynamics 365 Finance

Bluefort TAPP seamlessly integrates with the Credit and Collections module in Microsoft Dynamics 365 Finance. With this feature, you can configure the automatic creation of Credit and Collection cases based on specific GoCardless events.

Cases can be synchronised to Microsoft Dynamics 365 Sales / CE via dual-write to ensure account manager using CE are aware of credit and collection issues.

When any of the following events occur:

Failed Payment – When the payment has failed and you ran the Payment reconciliation, it will automatically create a case and a task. The case is linked to the created task. And the task is linked to the transaction where the payment has failed.

Offline Mandate Creation Failed – When the offline mandate creation failed, it will automatically create a case and a task if there isn’t any existing one.

Mandate Failure – When the mandate failed and you ran the Mandate reconciliation, it will automatically create a case and a task.

Mandate Blocked – When the mandate is blocked and you ran the Mandate reconciliation, it will automatically create a case and a task.

Mandate Expired – When the mandate is expired and you ran the Mandate reconciliation, it will automatically create a case and a task.

Mandate Cancelled – When the mandate is cancelled and you ran the Mandate reconciliation, it will automatically create a case and a task.

Unsettled Balance – When the Mandate Auto Cancellation batch job cannot cancel mandates because the customer still has an outstanding on-account balance.

A new Credit and Collection case is automatically generated in the system.

This ensures that the Credit and Collections team is promptly notified and can take the appropriate action to resolve the issue. By automating the case creation process, organizations can improve response time, reduce manual work, and maintain better control over customer credit risk and collection activities.

Integration with standard D365 Finance payment Days

TAPP can be configured to respect Microsoft Dynamics 365 Finance Payment days associated on a customer.

This feature allows companies to align customer payment collections with fixed weekdays or dates (e.g., every Thursday or the 15th of each month), rather than relying solely on invoice due dates.

You can define a Collection Day for each customer using the existing Payment Day field in Dynamics 365 Finance and Operations.

For more information please refer to this article.

Integration with standard D365 Finance Payment Schedules

TAPP can be configured to respect Microsoft Dynamics 365 Finance Payment schedules associated to a customer.

The Payment Schedule feature in Microsoft Dynamics 365 Finance enables businesses to define when, how, and in what structure payments are expected for a given sales or purchase transaction. It helps establish clear and enforceable payment expectations between merchants and customers.

For more information please refer to this article.

Capture full customer balance

It is possible to configure a parameter that when a GoCardless payment creation is triggered, upon posting an invoice, instead of just capturing the value of the invoice as the payment amount, TAPP captures the full customer balance of the customer. The logic only considers payment transactions which have reached their payment retry limit to ensure no transaction is double counted.

Integration with Microsoft Dynamics CRM/CE/Dataverse

Bluefort TAPP support customer mandate onboarding from a model-driven app within Microsoft Dynamics 365 CE / CRM / Dataverse. This app also comes bundled for free with TAPP Finance.

Existing GoCardless customer mandates migration

For more information please refer to this article.

Existing GoCardless customer payments migration

For more information please refer to this article.

Security

Bluefort TAPP is 100% secure and communicated to the GoCardless API using the OAuth 2.0 (TLS, HTTPS) protocol. Data is stored only at GoCardless or on your Microsoft Dynamics 365 Finance database. Communication happens exclusively between those two services. There is no intermediary service or database which stores any of your payment data, which is hosted by Bluefort.