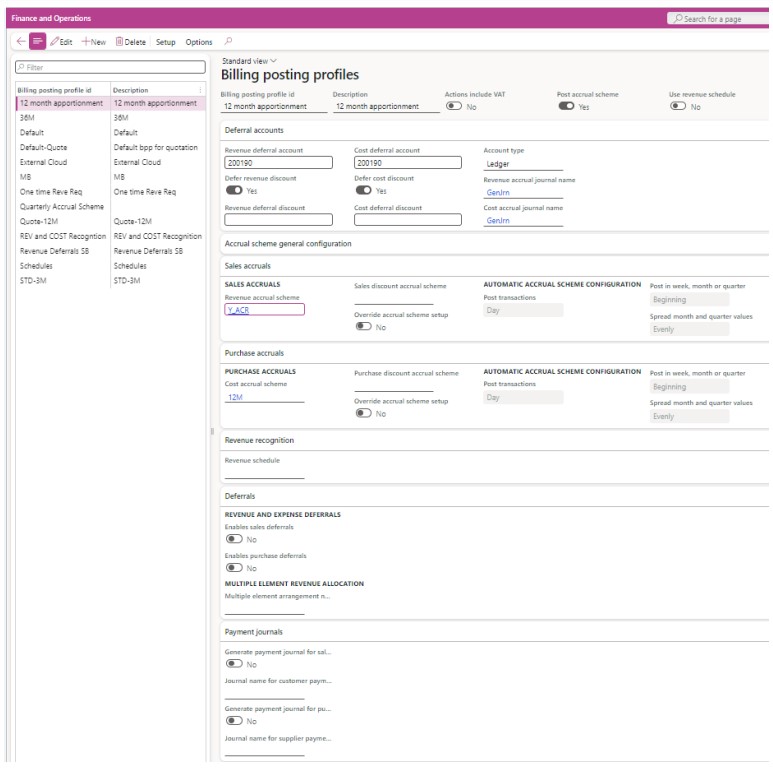

Billing Posting profiles (BPP) allow for advanced financial configuration features. Billing posting profiles can be linked to subscription commercial templates or directly to subscription plans in order to facilitate data entry of the financial parameters linked to a subscription plan, increase efficiency and reduce human error.

The Billing posting profiles form can be accessed from Enterprise subscription automation > Setup > Billing posting profiles or search for Billing posting profiles in the Search bar.

The following table shows an explanation of the fields:

| Field Name | Description |

| Billing posting profile id | Unique id of the billing posting profile |

| Description | More detailed description of the billing posting profile |

| Actions include Sales Tax (VAT) | If Sales Tax (VAT) is applicable according to VAT group and item VAT group setup, should this be calculated as part of the action amount? Note: this parameter works hand-in-hand but never interferes with the standard sales tax (VAT) behaviour of D365 on sales orders, purchase orders, sales invoices or purchase invoices. It only influences whether deposits and security deposits should be inclusive or exclusive of VAT (if applicable). If you do not use the subscription deposits functionality this flag can be ignored. |

| Post accrual scheme | When ticked, after an action of type sales order invoice or purchase order invoice is posted, the system automatically creates and posts a general journal to accrue the revenue and costs. For this to work, the parameters in the “Sales accruals” and “Purchase accruals” together with related standard D365 configurations must be correctly set up. |

| Use revenue schedule | When ticked, sales orders generated from actions resulting from this subscription plan are stamped with the revenue schedule set up in the “Revenue recognition” tab. This will trigger standard D365 revenue recognition functionality. |

| Perpetual + Enhancement Plan -> Applicable to | Used in revenue/cost recognition of P+EP plans only, this field defines for which type of scenario it can be used. The options are: 1. Maintenance only – This BPP is only applied for revenue/cost recognition of maintenance items 2. Recognition only – This BPP is only applied for revenue/cost recognition of items flagged as “Use for revenue/cost recognition” |

| Perpetual + Enhancement Plan -> Fall-back billing posting profile | Used in revenue/cost recognition of P+EP plans only, this is the fallback billing posting profile to use when no default billing posting profile can be found that can be applied to the scenario. |

| Deferral accounts -> Revenue deferral account | Usually used together with the Post Accrual Scheme feature, so that the revenue on the sales line generated when an action is firmed goes to an accrual account (or any other balance sheet account) and not to the standard revenue accounts. |

| Deferral accounts -> Defer revenue discount | If ticked and the sales discount accrual scheme is filled in, line discount amount and line percentage amount given on the subscription plan line (flowing down to actions and to sales orders lines / purchase order lines) will be posted to the main account specified in the “Revenue deferral discount” field and then accrued along-side the revenue. |

| Deferral accounts -> Revenue deferral discount | If the field “Defer revenue discount” is ticked, the line discount amount and line percentage amount given on the subscription plan line (flowing down to actions and to sales orders lines / purchase order lines) will be posted to the main account specified in this field which is typically an accrued discount or deferred discount or any other balance sheet account. If this field is empty and the field “Defer revenue discount” is ticked, then the discount will be posted to the main account specified in the field “Revenue deferral account”. |

| Deferral accounts > Cost deferral account | Usually used along with the Post Accrual Scheme feature, so that the cost on the purchase line generated when an action is firmed goes to an accrual account (or any other balance sheet account) and not to the standard cost accounts. Note that as per standard D365 behaviour, the cost deferral account is not applied to purchase order lines if the item model group linked to the line’s released product is set to “Stocked product”. So, it is not a best practice to used stocked products if you intend to use cost deferral functionalities. |

| Deferral accounts > Account type | Non-editable. Must always be ledger |

| Deferral accounts > Revenue accrual journal name | The journal name to use when creating the revenue accrual scheme general journal. |

| Deferral accounts > Cost accrual journal name | The journal name to use when creating the cost accrual scheme general journal. |

| Accrual scheme general configuration -> Enforce accrual scheme configuration | When this flag is turned on, the LISA accrual scheme posting logic ignores the length of the cycle on the action and always posts according to the number of months on the accrual scheme linked to this billing posting profile. It is recommended to keep this flag turned off unless there is a very specific scenario to justify turning it on. |

| Accrual scheme general configuration -> Immediate recognition % | If a value is entered in this field, the percentage value entered is recognised immediately in the first period. The rest percent is deferred according to the accrual scheme configuration chosen. |

| Accrual scheme general configuration -> Recognise start/end month by days | If ticked, revenue recognition for the first and last month covered by the action start and end dates will be done pro-rata by the number of days. |

| Sales accruals -> Sales accruals -> Revenue accrual scheme | The accrual scheme to use when accruing the revenue in the revenue accrual scheme general journal. Not all accrual schemes can be selected. See last chapter below of this lesson. |

| Sales accruals -> Sales accruals -> Sales discount accrual scheme | The accrual scheme to use when accruing the sales discount in the revenue accrual scheme general journal. Not all accrual schemes can be selected. See last chapter below of this lesson. |

| Sales accruals -> Sales accruals -> Override accrual scheme setup | Enables the fields in the Automatic accrual scheme configuration field group. |

| Sales accruals -> Automatic accrual Scheme configuration -> Post transactions | The default periodic type (day, week, month, quarter) for any sales/revenue accrual scheme records automatically created by the LISA HARP BusinessPro process. |

| Sales accruals -> Automatic accrual Scheme configuration -> Post in week, month or quarter | The default point in time posting type (Beginning, middle, end) for any sales/revenue accrual scheme records automatically created by the LISA HARP BusinessPro process. |

| Sales accruals -> Automatic accrual Scheme configuration -> Spread month and quarter values | The default way the periodic posting is spread between periods (evenly or based on the number of days in the period) for any sales/revenue accrual scheme records automatically created by the LISA HARP BusinessPro process. |

| Purchase accruals -> Purchase accruals -> Cost accrual scheme | The accrual scheme to use when accruing the cost in the cost accrual scheme general journal. The accrual scheme to use when accruing the revenue in the revenue accrual scheme general journal. Not all accrual schemes can be selected. See last chapter below of this lesson. |

| Purchase accruals -> Purchase accruals -> Purchase discount accrual scheme | The accrual scheme to use when accruing the purchase discount in the cost accrual scheme general journal. Not all accrual schemes can be selected. See last chapter below of this lesson. |

| Purchase accruals -> Automatic accrual Scheme configuration -> Post transactions | The default periodic type (day, week, month, quarter) for any purchase/cost accrual scheme records automatically created by the LISA Master process. |

| Purchase accruals -> Automatic accrual Scheme configuration -> Post in week, month or quarter | The default point-in-time posting type (Beginning, middle, end) for any purchase/cost accrual scheme records automatically created by the LISA Master process. |

| Purchase accruals -> Automatic accrual Scheme configuration -> Spread month and quarter values | The default way the periodic posting is spread between periods (evenly or based on the number of days in the period) for any purchase/cost accrual scheme records automatically created by the LISA Master process. |

| Revenue recognition -> Revenue schedule | With this field filled in, subscription plans having the current billing posting profile will be linked to features provided by the Revenue recognition module of Dynamics 365 Finance. With this field you can define the revenue schedule for the generated orders and thus integrate with the standard revenue recognition features. Please note that revenue schedules only work on the sales side of the books and do not accrue costs. Note: For this field to be visible the standard Revenue recognition configuration key of Dynamics 365 Finance needs to be switched on. |

| Deferrals -> Revenue and Expense Deferrals -> Enables sales deferrals | This flag enables standard revenue deferrals logic from the standard Subscription Billing module without having to configure default deferral templates from the module itself. The deferral start and end date of the revenue deferral schedule are automatically calculated based on the start and end date of the sales invoice action. Note: The relevant features must be turned on from the standard Feature management screen for this functionality to work. Important note: All items (and/or their related item group/category) that will be used in subscription plan / plan lines containing a billing posting profile with this field set to true, should not simultaneously also be listed in the standard form called Items deferred by default as this would cause issues when posting. |

| Deferrals -> Revenue and Expense Deferrals -> Enables purchase deferrals | This flag enables standard cost deferrals logic from the standard Subscription Billing module without having to configure default deferral templates from the module itself. The deferral start and end date of the cost deferral schedule are automatically calculated based on the start and end date of the purchase order action. Important note: All items (and/or their related item group/category) that will be used in subscription plan / plan lines containing a billing posting profile with this field set to true, should not simultaneously also be listed in the standard form called Items deferred by default as this would cause issues when posting |

| Deferrals -> Multiple Element Revenue Reallocation-> Multiple element arrangement number | If you would like to integrate subscription plans with the standard D365 Finance Multi element reallocation functionality then choose the applicable MEA template in this field, else leave this field blank. |

| Payment journals -> Generate payment journal for sales actions | Should a customer payment journal be automatically generated for a posted sales action? If turned on, this automates the process of creating customer payment journals and allocating it to the sales invoice of the posted sales action. When payment is received from the customer, the payment journal should be manually posted either from the standard D365 Finance screen or from the Post payment journal button on the Historical actions tab of the Subscription management cockpit or from the Actions inquiry list page. |

| Payment journals -> Journal name for customer payment journals | The journal name to use for the customer payment journal created automatically if the above parameter flag is turned on. |

| Payment journals -> Generate payment journal for purchase actions | Should a vendor/supplier payment journal be automatically generated for a posted purchase action? If turned on, this automates the process of creating vendor/supplier payment journals and allocating it to the vendor/supplier invoice of the posted purchase action. When payment is sent to the vendor/supplier, the payment journal should be manually posted either from the standard D365 Finance screen or from the Post payment journal button on the Historical actions tab of the Subscription management cockpit or from the Subscription actions inquiry list page. |

Setup Buttons

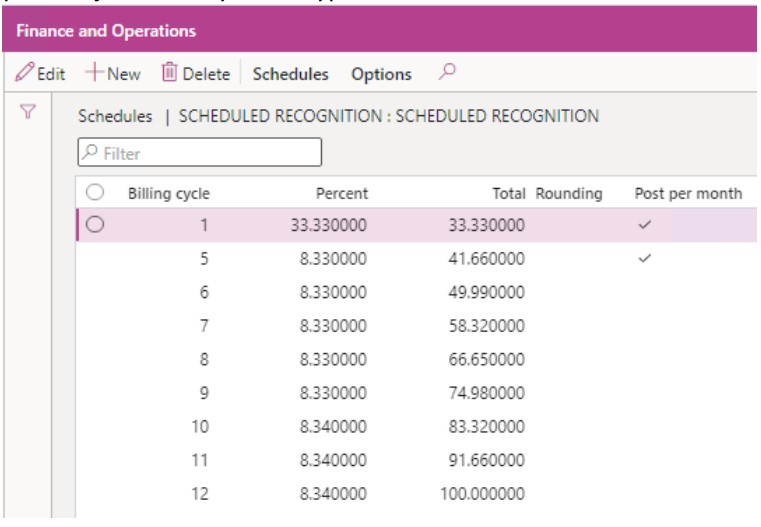

There are two main Setup buttons for Billing posting profiles. The first is the Schedules menu. This allows you to create scheduled revenue recognition postings. In order for this functionality to be used by the master process, the “Post accrual scheme” flag and the “Use revenue schedule” flag must be both switched off on the billing posting profile. Contrary to accrual schemes, schedules will only release revenue from the deferred revenue account when a billing cycle is processed. This is done by generation of actions which need to be firmed and posted, just like any other type of action.

The following table shows an explanation of the fields:

| Field Name | Description |

| Billing cycle | The billing cycle number this scheduled revenue or cost recognition record applies to. |

| Percent | The percentage revenue or cost to recognise in this billing cycle. |

| Total | This is a percentage cumulative total of all records with a smaller billing cycle than the current record and including the current record – not editable. |

| Rounding | Whether the resulting revenue or cost recognition amount is rounded to the nearest. |

| Post per month | If the billing cycle encompasses more than one month, ticking this box will recognise the revenue or cost on a monthly basis. This field has no effect if the subscription plan billing cycle is monthly. |

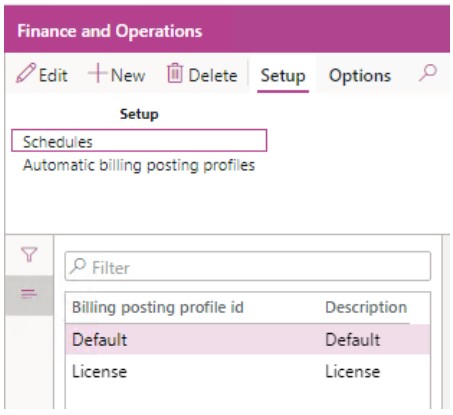

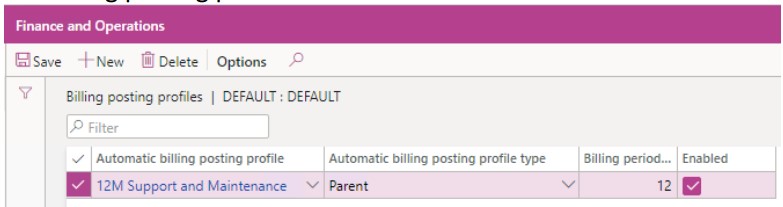

The second button, Automatic billing posting profiles, was added in the October 2020 release of LISA. This feature allows you to define a billing posting profile on the plan line level which, if not empty, overrides the Billing Posting Profile set on the header.

With automatic billing posting profiles you can define the billing posting profile to be picked up on the plan line level based on the cycle length of the plan line. You can also define if the automatic billing posting profiles applies only to Parent Products, Add-on Products or to both.

Automatic billing posting profiles are linked to a ‘parent’ billing posting profile (i.e. the billing posting profile which had focus when the “Automatic billing posting profiles” button was clicked). The ‘parent’ billing posting profile must be set on the plan header level for the ‘child’ Automatic billing posting profiles to be considered on the plan line level.

The automatic billing posting profile record must be enabled to be considered on the plan line level.

The user can still override the inferred automatic billing posting profile on the plan line level if the automatic billing posting profile does not cover the required scenario.

The following table shows an explanation of the fields:

| Field Name | Description |

| Automatic billing posting profile | Choose the billing posting profile applicable to this record. Each billing posting profile created as records in this table will essentially become child billing posting profile to the parent billing posting profile. |

| Automatic billing posting profile type | The type of automatic billing posting profile. > Parent – Will only be applied to subscription plan lines referencing a product which is a parent (not add-ons) > Add-ons – Will only be applied to subscription plan lines referencing a product which is an add-on > All – Will be applies to subscription plan lines having any product type |

| Billing period months | What is the length of the billing cycle in months when this automatic billing posting profile is to be applied. |

| Enabled | Only enabled automatic billing posting profiles are considered in the logic to deduce which automatic billing posting profile to apply. |

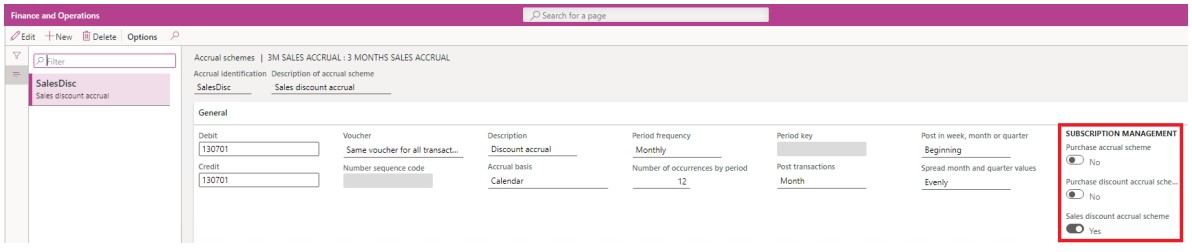

Extensions to Standard Accrual Schemes

A new “Enterprise subscription automation” field group has been added to the standard Accrual schemes form. The following table shows an explanation of the fields:

| Field Name | Description |

| Subscription management -> Purchase accrual scheme | When ticked this accrual can be selected in the “Cost accrual scheme” field on the LISA billing posting profile. |

| Subscription management -> Purchase discount accrual scheme | When ticked this accrual can be selected in the “Purchase discount accrual scheme” field on the LISA billing posting profile. |

| Subscription management -> Sales discount accrual scheme | When ticked this accrual can be selected in the “Sales discount accrual scheme” field on the LISA billing posting profile. |

All accrual schemes with all the above flags switched off can be selected in the “Revenue accrual scheme” field on the LISA billing posting profile.