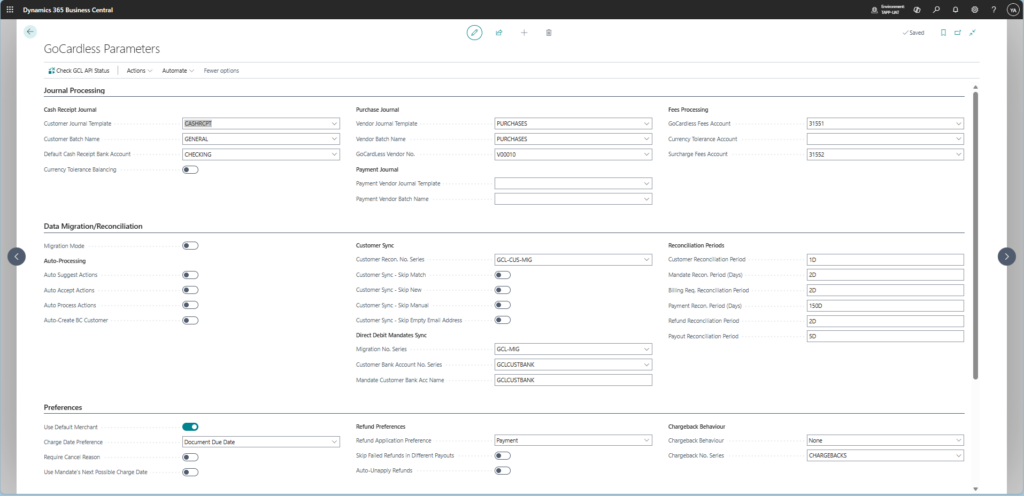

The below article gives an overview of the parameters used in GoCardless for Dynamics 365 Business Central – TAPP and their definitions.

Journal Processing Section

| Parameter Name | Definition |

|---|---|

| Customer Journal Template | The default template name to use when creating a cash receipt journal during payout processing. |

| Customer Batch Name | The default batch name to use when creating a cash receipt journal during payout processing. |

| Default Cash Receipt Bank Account | The default bank account to use when creating the Cash Receipt during payout processing. |

| Currency Tolerance Balancing | Enable this switch if for FCY payouts, a currency tolerance line should be inserted to balance the journal. |

| Vendor Journal Template | The default journal template to use when creating a purchase journal for fees during payout processing. |

| Vendor Batch Name | The default batch name to use when creating a purchase journal for fees during payout processing. |

| GoCardless Vendor No. | The vendor number to use when processing the payout fees. |

| Payment Vendor Journal Template | The default journal template to use when creating a payment journal to process the payout fees. |

| Payment Vendor Batch Name | The default batch name to use when creating a payment journal to process the payout fees. |

| GoCardless Fees Account | The Tolerance G/L account to use when processing the payout fees. |

| Currency Tolerance Account | The G/L account to use for the currency tolerance line when FCY payouts are processed. |

| Surcharge Fees Account | The G/L account to use when processing the surcharge fees in a payout. |

| Mandate Customer Bank Account | The Default Bank Account Name to use when creating a Customer Bank Account to link with the mandate. |

Data Migration/Reconciliation

| Parameter Name | Definition |

|---|---|

| Migration Mode | Enables the migration mode. Use this only when you are setting up TAPP for the first time or onboarding a new GoCardless merchant. |

| Auto Suggest Actions | Automatically suggests actions for synchronization records. |

| Auto Accept Actions | Automatically accepts actions for synchronization records. |

| Auto Process Actions | Automatically processes actions for synchronization records. |

| Auto-Create BC Customer | Automatically creates a Business Central customer when the synchronization process suggests to create a new customer. |

| Customer Recon. No. Series | The Reconciliation No. Series to use for Customer Reconciliations used to synchronize customers. |

| Customer Sync – Skip Match | During customer synchronization, skip the processing of reconciliation records suggested as Match |

| Customer Sync – Skip New | During customer synchronization, skip the processing of reconciliation records suggested as New |

| Customer Sync – Skip Manual | During customer synchronization, skip the processing of reconciliation records suggested as Manual |

| Customer Sync – Skip Empty Email Address | During customer synchronization, skip GoCardless customers that were retrieved without an email address. |

| Migration No. Series | The Reconciliation No. Series to use for DDM Reconciliations used to synchronize direct debit mandates. |

| Customer Bank Account No. Series | The Customer Bank Account No. Series to use for the creation of new Customer Bank Accounts in BC. |

| Mandate Customer Bank Acc Name | The Default Bank Account Name to use when creating a Customer Bank Account to link with the mandate. |

| Customer Reconciliation Period | Specifies the period to take in consideration when synchronising customers. |

| Mandate Recon. Period (Days) | Specifies the period to take in consideration when synchronising mandates. |

| Billing Req. Reconciliation Period | Specifies the period to take in consideration when synchronising billing requests. |

| Payment Recon. Period (Days) | Specifies the period to take in consideration when synchronising payments. |

| Refund Reconciliation Period | Specifies the period to take in consideration when synchronising refunds. |

| Payout Reconciliation Period | Specifies the period to take in consideration when synchronising payouts. |

Preferences Section

| Parameter Name | Definition |

|---|---|

| Use Default Merchant | Specifies whether to use the default merchant in Sales Documents. |

| Charge Date Preference | Specifies the preference to use when calculating the charge date of the GoCardless Payment. |

| Require Cancel Reason | Specifies whether the user is required to provide a reason why the payment is being cancelled. |

| Use Mandate’s Next Possible Charge Date | Specifies whether to use the mandate”s Next Possible Charge Date when retrying a payment. |

| Refund Application Preference | Specifies the preference against which customer ledger entry type will a GoCardless Refund be applied when processing refunds in GoCardless Payouts. |

| Skip Failed Refunds in Different Payouts | Specifies whether processing of a refund during payout processing should be skipped if that refund results to be failed in a separate payout. |

| Auto-Unapply Refunds | Determines whether refunds should be automatically unapplied when being reversed due to Refund Funds Returned in payouts. |

| Chargeback Behaviour | Specifies what the system should do when a Chargeback is received and processed during payout processing. |

| Chargeback No. Series | Specifies the No. Series to use when creating journals for Chargebacks during payout processing. |

Number Series Section

| Parameter Name | Definition |

|---|---|

| Payment (Cash Receipt) No. Series | Specifies the No. Series to use when creating journals for customer payment processing during payout processing in the Cash Receipt Journal. |

| Refund (Cash Receipt) No. Series | Specifies the No. Series to use when creating journals for customer refund processing during payout processing in the Cash Receipt Journal. |

| Surcharge No. Series | Specifies the No. Series to use when creating journals for Surcharge Fees during payout processing. |