Obtaining the Software

This page explains how you can get the Bluefort Payment Automation module deployed in your Dynamics 365 Finance and Operations environment.

1. Download the deployable package by:

- Visiting this URL: https://learn.bluefort.eu/knowledge-base/getting-started-with-bluefort-tapp/

- Providing the necessary details;

- First Name,

- Last Name

- Company Name

- Job Title

- Doing the “I’m not a robot” reCAPTCHA test.

- Clicking on Submit

After clicking on the Submit button a password is displayed. This can be used to unzip the archive which can be downloaded from the GitHub URL which is also displayed. It is advisable to always download the latest version.

Note: To unzip the archive you must first download and install 7zip.

2. Once you’ve downloaded the deployable package you can follow the steps outlined by standard Microsoft documentation on how to install a deployable package on a FinOps environment. Keep in mind that if you have other ISV solutions or deployable packages on your environment you might need to create an “all-in-one” package.

Information on how to apply updates to a cloud environment can be found here.

Information on how to apply updates to on-prem environments can be found here.

3. Optional Step: If you would like to be notified when Bluefort releases a new version of the solution we recommend that you provide the Bluefort support team with a list of usernames (e.g. jdoe@contoso.com) that should be invited to the LISA LCS project called Bluefort Payment Automation.

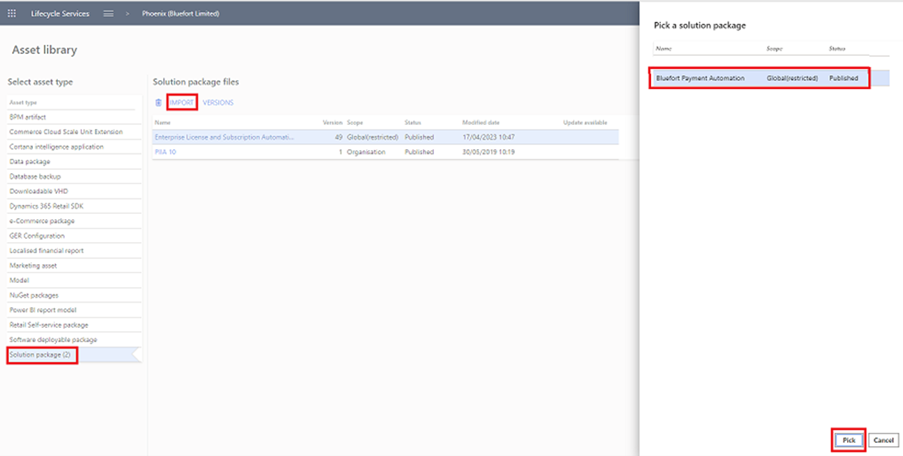

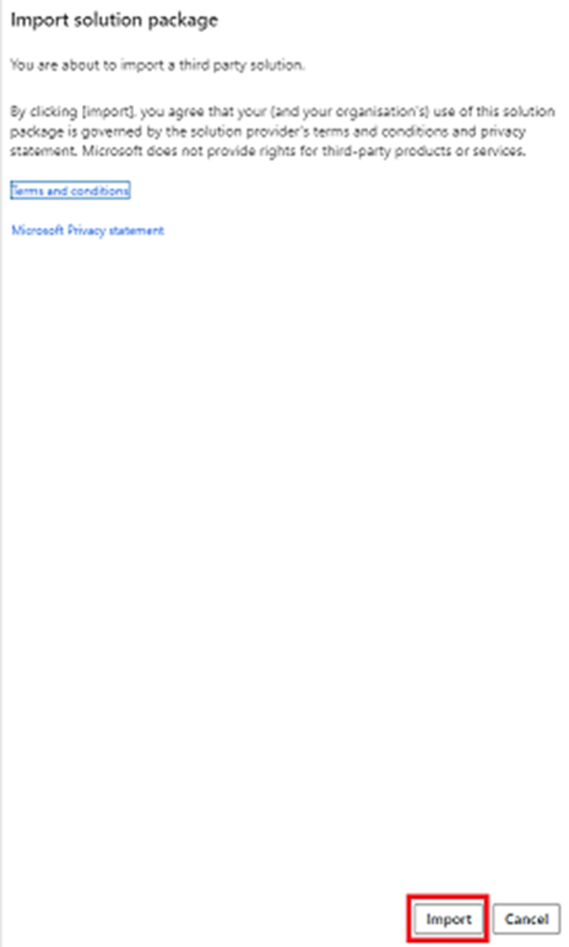

4. Optional Step: Once the above users are added by Bluefort support team, the users will be able to obtain the Bluefort Payment Automation files. From the LCS Asset Library, pull the latest (or specific) version of the Bluefort Payment Automation solution package which contains the Software Deployable Package. The process is summarised in the screenshots below.

Note: After confirming the pop-up dialog the import process via LCS might take some time.

When there is a new version of the software, a notification email is sent by LCS and the Versions button can be used to pull the latest version of the deployable package, assuming the steps listed as optional earlier in this guide have been executed.

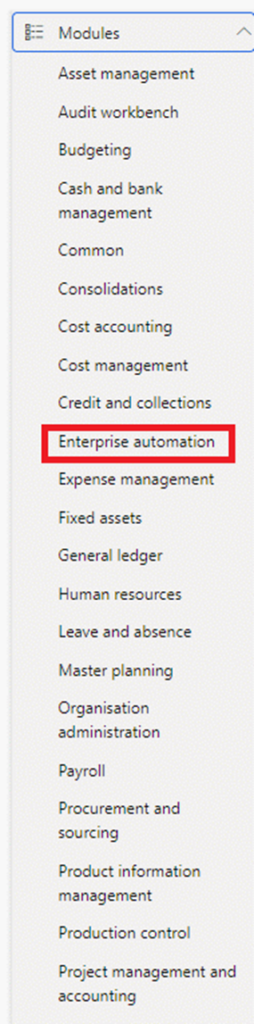

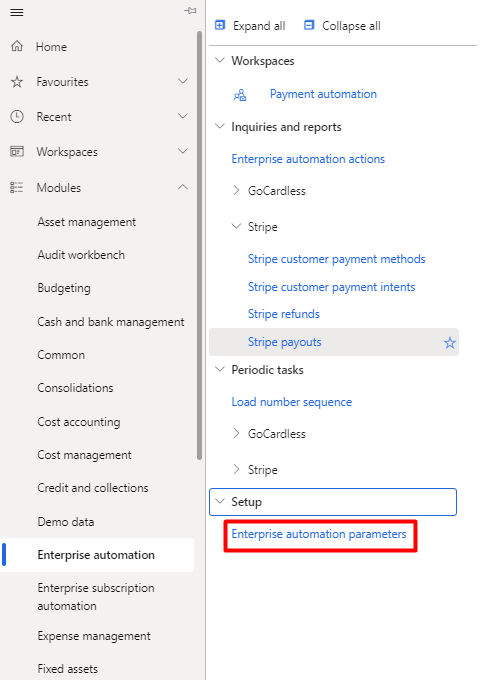

Upon successful deployment of the module, you should see a new module called Enterprise Automation in the main menu of Dynamics 365 Finance and Operations, as shown in the screenshot below.

The Enterprise Automation module has two roles. One is an administrator role which allows access to all the modules. The other is a user role that allows access to all the modules except the Setup/parameters sub-menu/form.

Non-admin users must be assigned the user role in order to use the functionality within the module.

Configuring the Enterprise Automation module to enable Bluefort Payment Automation

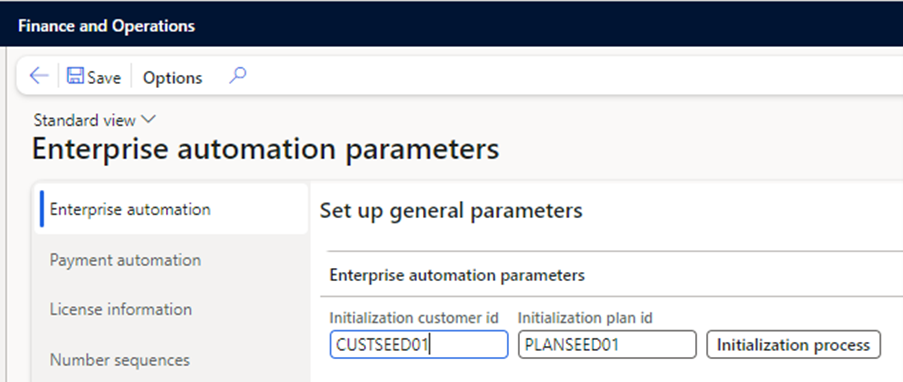

The first step is to go to the Enterprise automation parameters form.

Within the Enterprise automation tab enter values for the Initialization customer id and the Initialization customer id fields. These will only be used for seeding purposes. Once the values are entered, click on the Initialization Process button. This initializes the Bluefort Actions Framework and only needs to be done once per legal entity.

Note: The Initialization customer id must be a unique customer id field in the customers table. This customer id will only be used for seeding purposes and won’t be an actual customer. Ensure that the Initialization customer id is not a unique id of an existing customer or an id of a customer that might be assigned to a new future customer manually or via a number sequence.

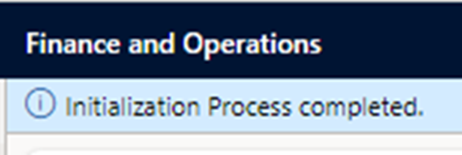

If any validation errors pop-up please rectify them accordingly or contact Bluefort support on support@bluefort.eu if you have any questions. When the initialization process is successful an Infolog is displayed and you may proceed to the next configuration steps.

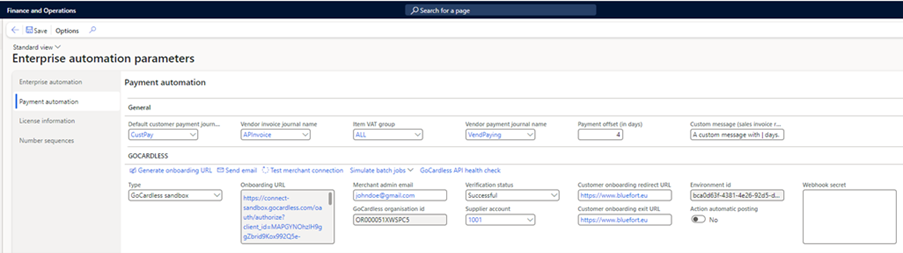

The next step is to go to the Payment automation tab.

This tab is divided into multiple fast tabs.

The General Fast Tab

Here you should configure fields that apply to one or more payment providers (i.e. not specific to one payment provider). The fields to configure are:

- Default customer payment journal – The customer payment type journal name to use when creating customer payment journals for payments processed via the payment providers.

- Vendor invoice journal name – The vendor invoice type journal name to use when creating vendor invoice journals to record charges from the payment providers as a vendor invoice. Note: not all payment providers support vendor invoicing.

- Item VAT group / Item sales tax group – The item vat (sales tax) group is to apply to vendor invoice journal lines when recording charges from the payment providers as a vendor invoice.

- Vendor payment journal name – The vendor disbursement type journal name to use when creating vendor payment journals to record the payment for the vendor invoices that are created to record charges from payment providers.

- Payment offset (in days) – The payment offset in days after the invoice when the first attempt to transfer the funds will be made.

- Custom message (sales invoice report) – Define the message to be shown on the sales invoice document when an invoice will be settled using a payment gateway or direct debit mandate. Use the wild character | to denote the number of days after the sales invoice date the first attempt to transfer the funds will be made.

IMPORTANT CONFIGURATION NOTICE

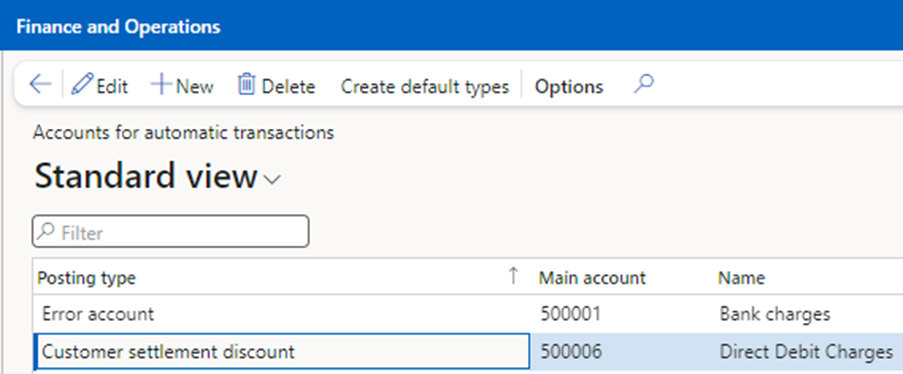

Any charges from the payment gateway provider for the transaction are posted to General Ledger with the posting type: Customer settlement discount because the original customer transaction needs to be settled in full even though you receive a partial amount (the full settlement account minus the fee) in your bank account from the payment gateway provider. Thus it is important to ensure the following two pieces of configuration are done before any customer payment journals are posted:

1. Accounts for automatic transactions -> Posting type = Customer settlement discount is set to point to the expense account where you want to recognize the cost of the payment gateway provider (e.g. Direct Debit Charges of type Expense)

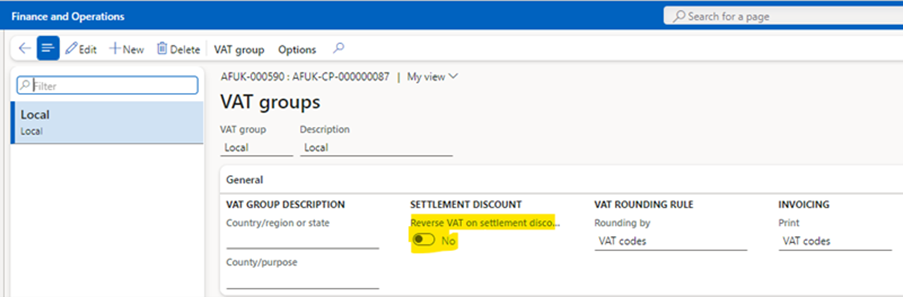

2. The VAT group (Item tax group) assigned to the customer / sales order / invoice has the field Reverse VAT (Sales tax) on settlement discount set to No. This ensure that your VAT (Sales tax) obligation is not deducted for the portion of the sales value which was allocated as a direct debit charge.

The Stripe Fast Tab

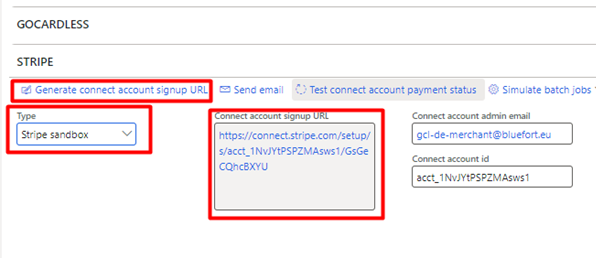

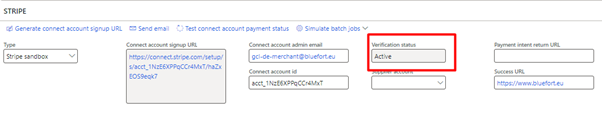

In this tab you should configure fields specific to the Stripe integration. The first step to configure Stripe would be to Generate connect account signup URL. To perform this, first select the type of endpoint you want to connect to in the Type field. For testing in sandbox/UAT environments make sure to use the Stripe Sandbox endpoint. For Live/Production environments use the Stripe live. After making your selection, proceed to generate the connect account URL by clicking on the Generate connect account signup URL button. This should generate the URL in the Connect account signup URL field.

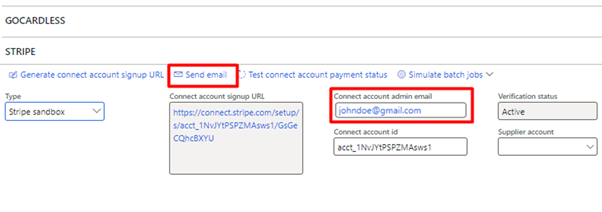

Fill in the connect account admin email field and forward the Onboarding URL to this email address by using the Send email button. In a production/live scenario, the connect account admin should be a legal representative of the legal entity who has the authority to sign up the legal entity as a Stripe merchant. The URL can of course be shared manually by copying the value from the field however the Send email button is a handy tool to facilitate the sharing process.

Note: It is VERY IMPORTANT that the legal representative has an enabled user in the Dynamics 365 FSCM environment and has one of the Enterprise Automation roles described earlier in this document assigned to the user. If the user no longer requires access to Dynamics 365 FSCM, the role and user assignment can be revoked after completing the merchant onboarding process.

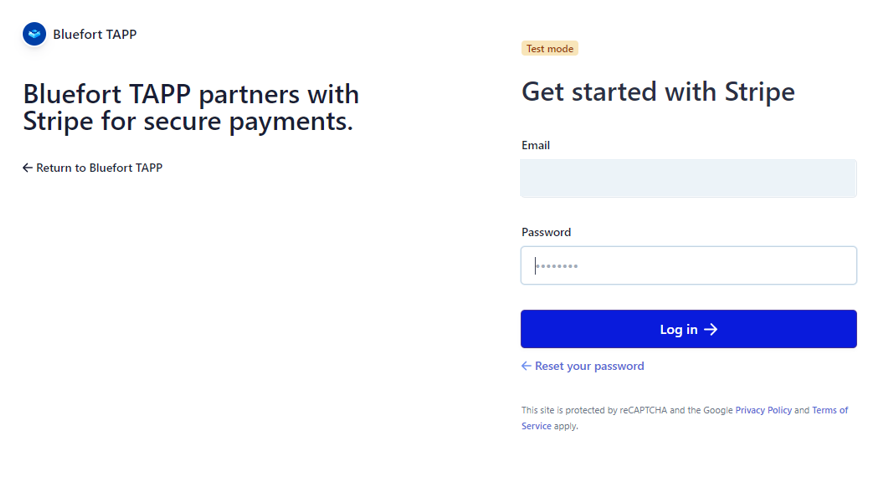

Once the legal representative of the legal entity receives the Onboarding URL and clicks it, the Stripe hosted page is presented. This wizard will guide the user through the merchant onboarding process for the legal entity. The first step in this wizard is to create an account with Stripe or sign-in if the legal entity was already signed up with Stripe in the past.

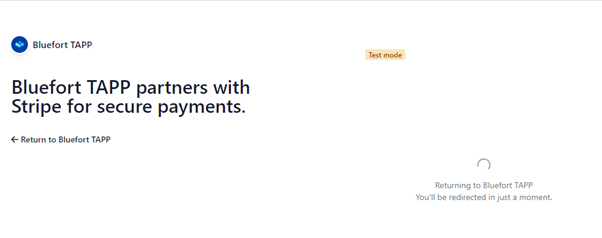

Proceed with filling the details as requested by the Strip payment gateway and after completion the user will be redirected to Bluefort TAPP page.

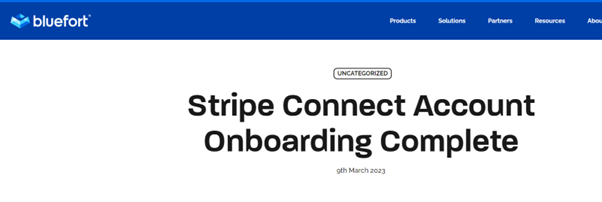

At the end of the wizard, the user will be re-directed to a page on the Bluefort website and if successful the organization information is directed to the Dynamics 365 FSCM legal entity.

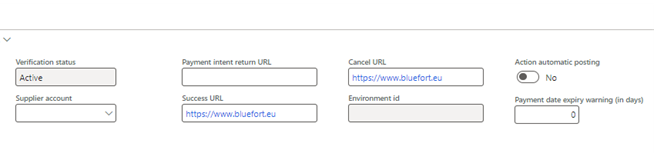

After the legal representative receives the success message the onboarding can be verified by ensuring that the Verification status has the value Active and the Connect account id field have a value

Other fields to configure:

Supplier/Vendor account – This is the supplier/vendor account from the company’s purchase ledger / AP module to represent Stripe as a supplier/vendor of the service. Supplier/vendor invoices and supplier/vendor payments created automatically for charges are created against this supplier/vendor account.

Payment intent return URL – This is the URL to redirect to when either the authentication or the cancelling of the payment on the payment method app or website is made. If it is desirable to redirect to a mobile application, this can also be done by alternatively supplying the application URI scheme.

Success URL – This is the URL to redirect to when the customer successfully make a payment or complete the setup of a payment.

Cancel URL – If this URL is set, when pressing the back button to cancel a payment from the checkout screen, customers are redirected to this URL.

Action automatic posting – Bluefort Payment Automation is based on the power and robustness of the Bluefort Actions framework. This field lets you control whether you want Stripe payment actions to be automatically posted or whether you want them to be created in a Firmed state for review before requesting the payment operation on the customer’s bank account. Setting this value to true requires less manual interaction but does not provide the opportunity for review. Typically, it is left turned off during the first phases of go-live and then turned on when the legal entity becomes familiar with the payment requests generated and can thus make full use of the automation capabilities.

Payment date expiry warning (in days)

This adds a yellow triangle warning icon marking the record, if the Expiry date less todays’ date value is smaller than or equal to the value configured in Payment date expiry warning (in days). The icon will show a red X error icon if todays’ date is larger than the Expiry date of the payment and should get automatically disabled.