Introduction

For customers already using Stripe and implementing Bluefort’s Stripe for Dynamics 365 Business Central – TAPP, a customer payment methods synchronization between Stripe and Business Central is necessary to continue using existing customer payment methods through TAPP. This article provides a step-by-step guide on how to perform this data synchronization and explains the criteria used during the matching process.

Pre-Requisites

- Stripe Stripe Customers synced to Business Central: as described in this article, the customer synchronization between Stripe and Business Central should be completed.

Synchronizing the Data

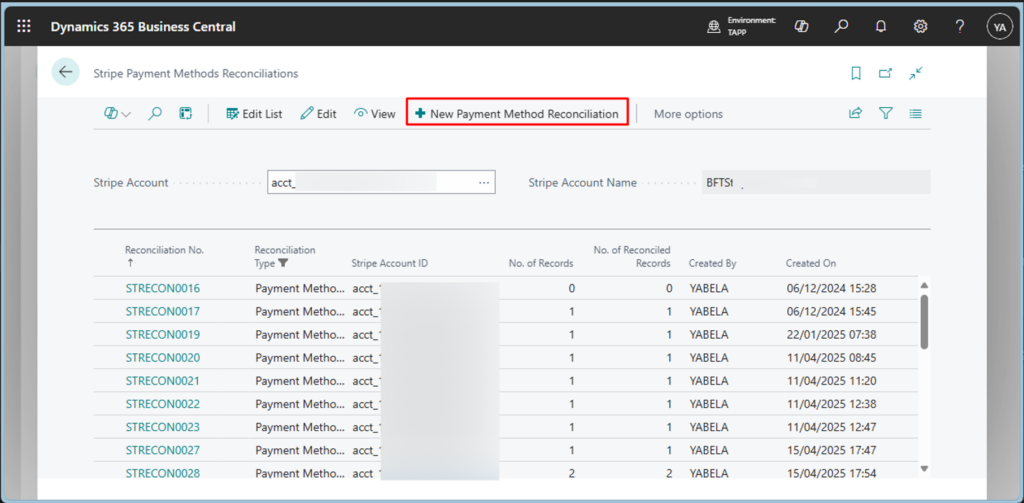

Synchronizing payment methods data from Stripe to Business Central is done through a page, accessible from the search menu, named Stripe Payment Methods Reconciliations which is the playground that will be used to carry out the data synchronization process.

Follow the steps below to carry out the data synchronization.

- Navigate to the Stripe Payment Methods Reconciliations page in Business Central

- Unless chosen by default, set the Stripe Account from which you want to synchronize customers.

- From the menu select New Payment Method Reconciliation and open the newly created record.

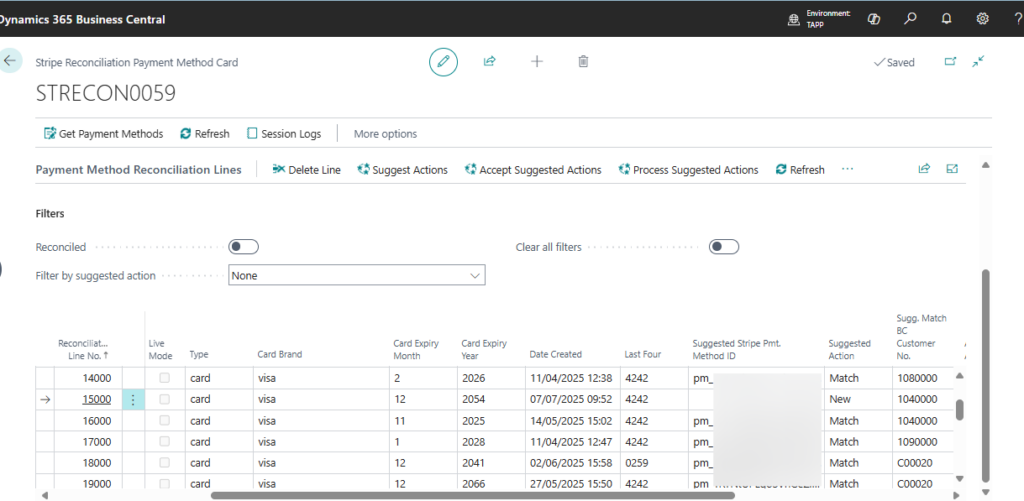

- Click on Get Payment Methods. This will start a background session to retrieve all customer payment methods in your Stripe Account.

- Once the session is complete and Payment Methods are returned, run the Suggest Action batch job from the action available in the menu. If this is the first time synchronization, it is suggested that this job be run for all records.

The outcome of this process is a suggestion on how each customer payment method retrieved from Stripe should be processed. The suggestions brought forward by the process are visible in the ‘Suggested Action’ field and this can be one of the below values;

| Suggested Action | Description |

|---|---|

| None | This sugested action can be because of two different findings i.e. 1. The process did not find the Stripe customer related to the payment method synced to a BC Customer. Text in Error Message field would also be: ‘The Stripe Customer ID is not linked to a BC Customer No.’ 2. The process identified that the payment method already exists in Business Central; however, it is linked to a different Business Central customer than the one associated with the Stripe Customer ID of the payment method. Text in Error Message field would also be; ‘The Payment Method already exist in BC but is linked to a BC Customer that is different than the BC Customer No assigned to the Stripe Customer ID.‘ |

| New | The process did find the related Stripe customer synced successfully but did not find the payment method synced to Business Central yet and therefore it is suggested to create a new Stripe Payment Method record in Business Central. |

| Match | The process did find both the related Stripe customer and the payment method synced successfully to Business Central. |

- The next step is to run the Accept Suggest Actions to accept the actions. Through this process, the suggested actions are confirmed and accepted by the user.

- The final step is to process all the actions which have been accepted by running the Process Suggest Actions. Depending on the suggested action, this process will carry out the necessary tasks as per below;

| Suggested Action | Task that will be carried out |

|---|---|

| None | No changes will be done in any record |

| Match | No changes will be done to any record as the payment method is already synced. A new record in the Payment Method History will be created for tracking purposes. |

| New | A new Payment Method Record will be created and linked to the BC Customer identified in the field Sugg. Match BC Customer No. |

Any issues encountered during the process are shown in the ‘Error Text’ field.